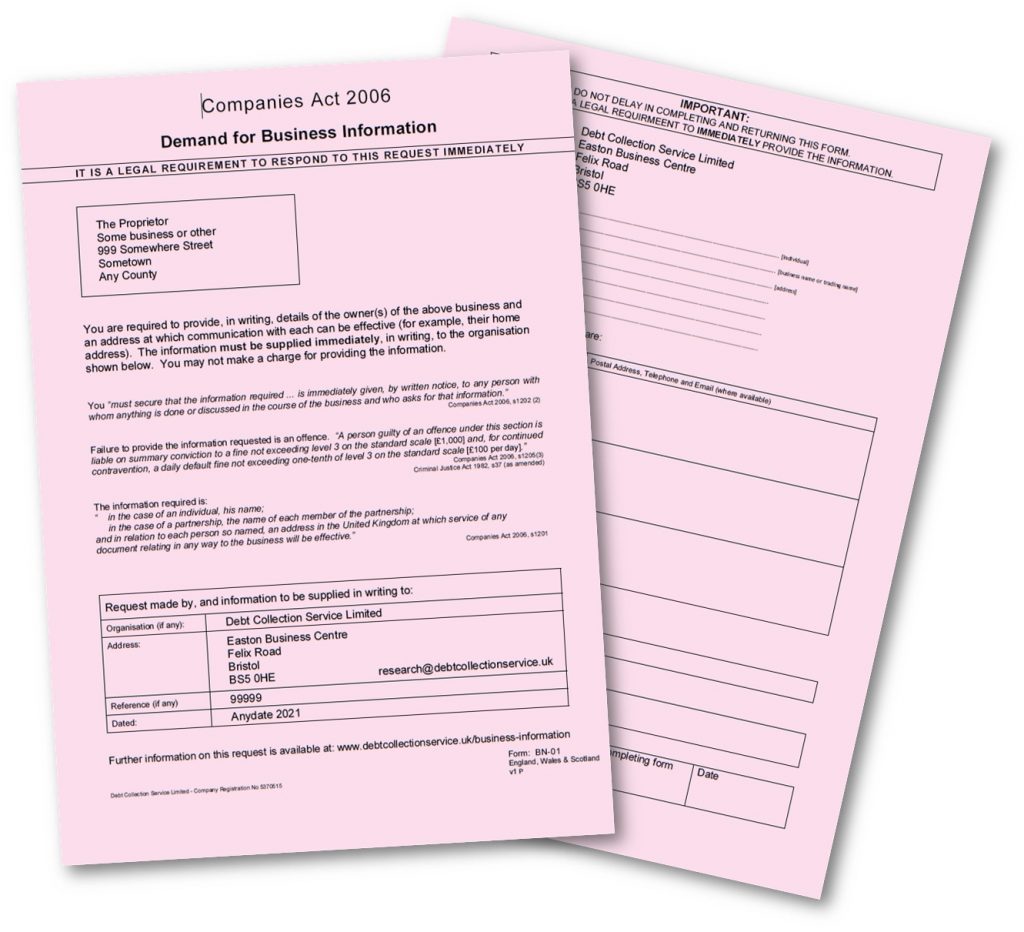

You are probably reading this webpage because you have received correspondence from us requesting information on the ownership of the business. The correspondence explains the legal basis for the request (demand) and the potential penalties for non-compliance.

The issue of a formal notice seeking information on a business does not necessarily mean that we have been instructed to pursue a debt against the business. There are many other potential reasons why we may be seeking the information. If we are pursuing a debt against the business, we will correspond with the business accordingly in due course. The statutory basis for the demand for business information does not require that the business has any debts. Accordingly, our correspondence does not provide any information on our client (if any) or any information on any debt (if one exists).

You “must secure that the information required … is immediately given, by written notice, to any person with whom anything is done or discussed in the course of the business and who asks for that information.”

Legislation: Companies Act 2006, s1202 (2)

Failure to provide the information requested is an offence. “A person guilty of an offence under this section is liable on summary conviction to a fine not exceeding level 3 on the standard scale [£1,000] and, for continued contravention, a daily default fine not exceeding one-tenth of level 3 on the standard scale [£100 per day].”

Legislation: Companies Act 2006, s1205 (3)

Legislation: The Criminal Justice Act 1982, s37 (as amended)

Legislation: Companies Act 2006, s1201The information required is:

“ in the case of an individual, his name;

in the case of a partnership, the name of each member of the partnership;

and in relation to each person so named, an address in the United Kingdom at which service of any document relating in any way to the business will be effective.”

Potential penalty for non-compliance:

£1,000 fine plus £100 per day

We have provided a convenient form to enable you to provide the relevant information to us promptly. If preferred, the completed form can be scanned / photographed and sent as an email attachment to research@debtcollectionservice.uk