Debt collection for Nursery Schools and other Childcare Settings

Collecting overdue childcare fees can be a difficult and sensitive issue for childcare providers. We can help!

Childcare providers, whether commercial or charitable, walk a difficult line between friendly exchanges with parents and carers, and the need to be paid for their services. The nature of childcare providers means that staff build up a relationship with the parents/carers. This relationship is about the care and wellbeing of the child, and not about financial matters. This makes it difficult for staff at the setting to talk about debt. By using an external party like DCS to pursue overdue accounts it means that your staff or volunteers are not actively involved in pursuing debts and can concentrate on providing and supporting childcare.

Where there is non-payment, excluding a child from the setting can be a difficult decision for the provider to make. What needs to remain important to the provider, however, is the long-term sustainability of the setting and the ability to provide a high quality service. Overdue accounts, or unpaid accounts, will put in to jeopardy the ability of the provider to continue providing a high quality service.

Paying nursery fees is often low on parent’s financial priorities and it can sometimes appear the easy option to avoid, or delay, making payment if the parent(s)/carer(s) are having a difficult financial time.

Childcare debt can slowly build up over time; this could be by regaularly unpaying or missing an occassional payment. Childcare debt can also occur after a change of circumstances; this could be a change to relationahips, reduction in working hours / pay, illness by the parent(s)/carer(s). Individuals can keep debts a secret from their partner or other family members, hoping that the matter will somehow resolve itself. It is important that providers keen a keen eye on overdue accounts, and ensure these are addressed before the debt becomes unmanageable for both parties.

If an area has a surplus of available childcare provision, there can be cases where people have run up large debts with one setting and then withdraw their children and take there custom to another setting a short distance away.

If the debt relates to an ongoing service user, we will often agree a payment plan to clear the arrears while the parent continues to pay the regular fees to the setting.

If the debt relates to a former service user, then there are often queries around payment for notice periods or when the child was unwell, or confusion around what elements of fees are paid by government schemes. We have experience of negotiating these difficult areas between the service provider and those that owe the money.

By seeking assistance from Debt Collection Service Limited it shows to your customer that you are serious about your debt. There may be a genuine reason why payments have not been made, or there may be an issue being able to continue to afford to pay for childcare. We will explore all of these issues with the debtor. Action through a County Court is usually not the best way of collecting overdue childcare costs. We would rather negotiate a settlement on behalf of the client. County Court action remains part of the options that could be used to collect overdue payments where this is necessary.

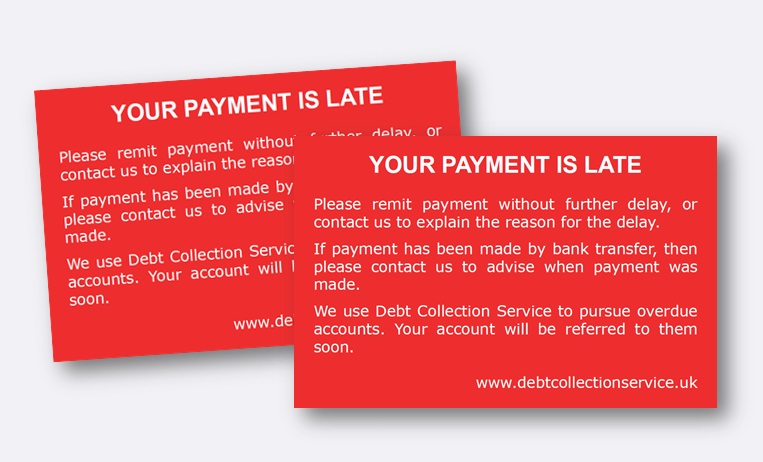

We provide our clients (free of charge) with “Your payment is late” cards that can be attached to reminder invoices sent out. This lets people know that you already have a relationship with DCS, and that we will be engaged if payment is not forthcoming.

One issue we often encounter with childcare providers is uncertainty around the contractual relationship; who is it that has agreed to pay for your services? Other issues encountered are ambiguous notice period requirements and uncertainty around what services the parent(s)/carer(s) are required to pay for. We have experience of handling all these issues, and aim to broker a solution between the childcare provider and those with an overdue account and bring the debt to a conculsion to the satisfaction of both parties.

✓ Tips to assist with credit control:

✓ Ensure there is no uncertainty as to who should be paying your fees. (Does this match the contract?)

✓ Aim to have your standard monthly fees paid in advance.

✓ Ensure your charging structure (including with regard to holidays, sickness and notice periods) is clear and known to the customer.

✓ Issue clear and easy to understand invoices showing the services being provided over what period, and when payment is due.

✓ Ensure your invoices provide clear information on the name of your business (for example “Whatever Nursery, a trading name of Whatever Childcare Services Limited”), and meet other legal requirements for invoices.

✓ Include your bank account details on invoices and statements to ensure your customer has your bank account details to hand to make prompt payment. Have you looked at collecting fees by Standing Order or Direct Debit?

✓ Pursue an overdue account as soon as it becomes overdue. An email or text along the lines of “Just a reminder that your payment for ?? was due yesterday. Please let me know if there is any difficulty.” can be a cheap, effective and friendly means of credit control.

✓ Send reminder invoices or statement for overdue accounts. If you normally hand invoices etc to the customer, then post copies of overdue invoices or statements to the customer (this also helps to ensure you have a current address for the customer).

✓ Devise and implement a Credit Management Policy to determine when a debt is referred to a third party like DCS.

✓ Keep a record of your contact with customers regarding overdue accounts, and note their response (if any).

✓ Ensure parents/carers have access to your Complaints Policy so that withholding payment is not the only route for a dissatisfied customer to raise their concerns. (Perhaps publish your Complaints Policy on your website.)

✓ Treat debt seriously. Review overdue accounts on atleast a monthly basis. If your setting gets a reputation for customers being able to ignore invoices, then the number of people not paying your invoices will increase.

Regardless of the procedures and policies implmented for the setting, there will still be some overdue accounts. Using Debt Collection Service Limited to pursue overdue accounts will increase the ability to recover overdue debts.

We charge a flat fee for taking on a new case. The remainder of our fees is based on what we recover from the debtor. This means the bulk of our fees are ‘success fees’ based on our ability to recover funds for our clients. Unfortunately, some debt collection agencies can act unscrupulously and either not pass fees collected on to clients or make unreasonable deductions from fees passed on. We ask debtors to make payment direct to the service provider.

Please call us on 0117 370 4236 or email office@childcaredebt.uk to discuss how we can help your childcare operation to collect overdue fees.